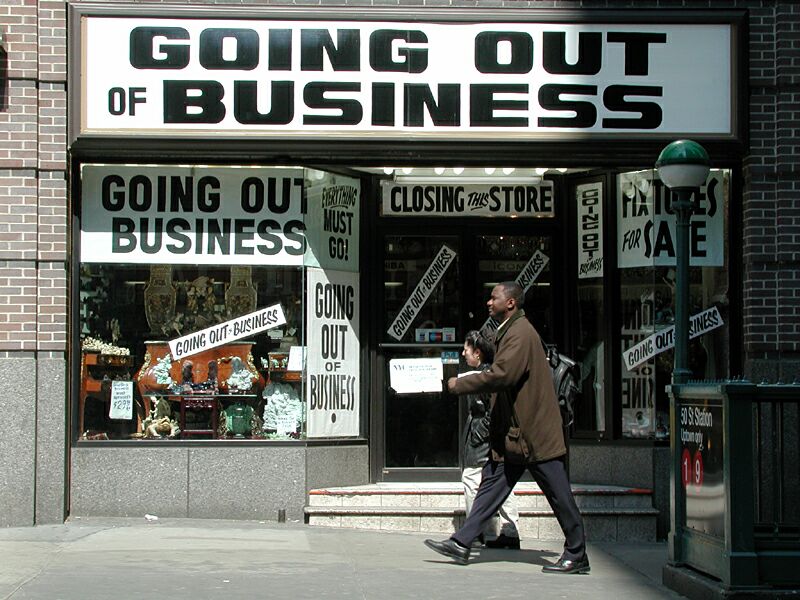

Every startup business is at risk of bankruptcy, but with extensive research it is possible to decrease the risks. Trying to get a startup established can be extremely difficult, which makes it almost impossible to avoid loss of revenue and significant debt. However, in most cases bankruptcy will be the business owner’s last resort. Since, such an action can lead to total failure, forcing the owner to close the business. Below, you will discover several tips for avoiding small business bankruptcy.

Every startup business is at risk of bankruptcy, but with extensive research it is possible to decrease the risks. Trying to get a startup established can be extremely difficult, which makes it almost impossible to avoid loss of revenue and significant debt. However, in most cases bankruptcy will be the business owner’s last resort. Since, such an action can lead to total failure, forcing the owner to close the business. Below, you will discover several tips for avoiding small business bankruptcy.

Find An Honorable Business Partner

If you can come up with a good business idea, it will be easy to find someone that is interested in turning the idea into a reality. When searching for a business partner, you should attend business seminars, where you will be able to meet people with similar business interests as you. Avoid just inviting the first person you meet to enter a partnership. Instead, wait for someone to come along that is honest, reliable and has a good business reputation. This individual will be able to help you establish, operate, fund and keep the business afloat during the tough times. A reputable attorney will provide you with a free consultation, if you are considering bankruptcy.

Getting Access To Cash

Once the business is established and you meet a hurdle, you will need to do whatever is necessary to recover. The status of the economy is always changing, making it extremely impossible to prepare for such barrier. If the business is failing, it will be in your best interest to start searching for cash. If you cannot find enough cash to suffice your needs, it will be impossible to identify and address the primary causes. As a new business owner, you may struggle obtaining a loan or convincing investors to step it up. So, you may be forced to liquidate a non-core portion of the company.

Another way to get access to cash is to tighten up your balance sheet. Now, this will not be easy, but it is possible as long as you are willing to commit to the idea. Of course, everyone involved in your business will have to be onboard with the idea for it to be successful.

Management Alterations

Struggling businesses may need to bring on new people, with new ideas. The ideas must be solid and feasible for them to help you business evolve. When you decide that it is time to make a management change, you will need to take every step to ensure you find the right person to fill the positions. As a business owner, you will be forced to sometimes make tough decisions and this will definitely be one of them. However, if you want to turn your business around, you will need to make the alterations and make them quickly.

If business-as-usual continues, you will find yourself filing bankruptcy, which is something that should be avoided at all costs. Bankruptcy is not good for any small business or the owner.

Admit That There Is A Problem

It isn’t unusual for a small business owner to deny that they have a cash flow problem. In fact, in many cases the problem will be allowed to go on for way too long. Admitting that there is a problem will help motivate you to find a quick and feasible solution.

Hiring A Consultant

Hiring a consultant that specializes in reviving a failing business is also a great option. The expert can add a fresh perspective to help solve the problems that are plaguing your business. Before hiring a consultant, you will want to perform an extensive background check on each available option. You should only consider a firm that has a lot of experience and a positive business reputation. An experienced consultant will be your best option, but you should expect to pay more for this level of service.

Ask for references before you actually make your final decision. You will want to speak with the consultant’s former clients, just to make sure they were satisfied with the service.

Learn more

Bankruptcy is a topic that probably fills any business owner, no matter the size of the business, with dread. However, if you’re a small business ...

If you have had to file for bankruptcy, your credit score will now be about as bad as it gets. A bankruptcy can stay on your file for as long ...

Getting the right lawyer for your business is very important. Legal trouble always seems to appear from nowhere and the last thing you need is to ...

The employees that work for you are a huge part of your business and without them you wouldn’t be able to function most days. Even if you’re a sma ...

So many people have the dream of starting their own business. This is great, but at the end of the day, you still have to make sure that it is the ...