Small businesses are always reporting scams that they are facing on a regular basis. Although there is no way for you to avoid being a target of these scams, you can learn from previous victims. The first step is to be aware of which scams are out there. Here are four types of small business scams to look out for.

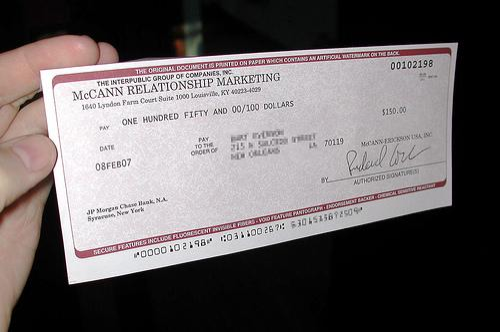

Overpayment Scam

The overpayment scam is among the most attempted scams against small businesses. A potential client calls up and places an order for one of your more expensive items. The customer then mails you a check for payment, and the check arrives in surplus of the invoice. When you call them to inquire, they act as if it was an error and because they are in such a hurry to receive your product, they want you to just deposit it, send your product to them, and issue them a refund for the overage via wiring them back the funds. Eventually, their check bounces with your bank, and you are stuck with the loss.

Directory Scam

You need to protect yourself against the popular phone scams — especially the directory scam. Scammers will call up small businesses to offer excellent visibility among business directories. All you have to do is pay their fee, and your business name will shoot to the top of the list making it more visible to potential customers. The truth is, most of these calls are fake, and they are simply scammers trying to get you to pay them over the phone and give them access to your credit card or bank account number.

Tech Support Scam

Another dangerous phone scam that small business staff falls for is the call they receive from “tech support.” One day, one of your employees may get a call from someone claiming to be from tech support and working on your “IT problem.” This call could sound legit to an employee, and when they are asked for passwords, they may not see any reason not to provide that information. So share this scam with your employees, and let them know to never give someone their passwords over the phone.

Phishing Scam

Phishing scams via email have been around for a long time, but more and more, these scammers are attempting to strike small businesses. Emails show up in your inbox looking completely legit. But when you click on the attached link, you automatically download viruses that attack your computer and transfer your personal information to hackers. They can download information such as social security numbers, bank accounts, and so much more that can ultimately hurt you and your employees. Be on the lookout for strange emails. Even if the email is from a known person, question it when they are unexpectedly sending you a link. It is better to ignore and have been wrong than to click and fall prey to scammers.

IRS Scams

One of the most popular scams is the IRS scam. However, these types of scams can be relatively easy for employees to avoid if they are aware of them. It’s important to note that the IRS will always contact you via mail, prior to reaching out over the phone. The IRS would also never ask for personal information, such as your social security or credit card numbers over the phone. Additionally, they would never threaten to arrest or sue you.

As a small business owner, you can’t prevent people from trying to scam you. However, when you are aware of the types of scams they are trying to commit, you are more likely to avoid falling victim to the scam.

Learn more

There are quite a few challenges you face while trying to enhance the quality and profitability of your business. One of these challenges, and rat ...

Anyone can end up on the receiving end of telephone fraud. That is why ensuring you have an effective strategy in place for telephone fraud preven ...

Anyone who wants to start making money through trading will be interested in finding a broker for their trades. There are plenty available to choo ...

Getting into the stock market can be intimidating. If you’ve done a little research, you’ve probably heard about penny stocks, and you’ve probably ...

Whether you are accepting mobile payments or take payments online, chargebacks come with being a merchant and they are an inevitable occurrence th ...